Producing Medical Innovations Right Here at Home

Purchased on GettyImages. Copyright.

Innovation in the medtech sector is a strategic priority for the Quebec government, as evidenced by its funding programs. However, is it not disappointing to know that many of our medical innovations are produced elsewhere?

It would be in Quebec’s interest to have companies manufacture medical technologies here. The funding sources available and our numerous academic institutions make Quebec a hub for R&D. Some funding programs reimburse production expenses and performance studies required to obtain regulatory approval. Kinova® is one company that takes advantage of these assets with its in-house manufacturing, but this option is not for everyone. Many are turning to subcontracting and, unfortunately, some programs refuse to reimburse outsource manufacturing.

However, this is far from being a deterrent, as adequate local subcontractors with an ISO 13485 certification are in very short supply. Conversely, there are hundreds of American manufacturing contractors specialized in medtech.

To better understand the issue, I spoke with various stakeholders in the national innovation system, the medtech sector and the manufacturing sector.

Diversification

The COVID-19 pandemic has hurt some economic sectors, like the aerospace industry—a sector already known for its sensitivity to economic cycles. Government investments are aimed at diversifying this industry to address the problem. Getting into medical device manufacturing can represent an opportunity for diversification. Indeed, many medical devices are produced using the same manufacturing processes as aircraft. Also, the medtech sector must comply with the ISO 13485 standard—based on ISO 9001, which is widespread in several sectors, including aeronautics.

The Risk for Manufacturers

NSE Automatech® is a rare example of a company serving both the aerospace and medtech sectors. In a meeting with NGen members, I learned that many manufacturers do not perceive the medtech sector as an area with strong growth potential. This is because, compared to large American companies such as Medtronic® or GE Healthcare®, Quebec companies are mostly SMEs that represent a risk for manufacturers. These SMEs do not create as much demand. Many are still in the start-up phase—the volume of production they need is only for design verification & validation studies.

Even if their targeted market promises high sales volumes, there is no guarantee of success. SMEs may not obtain regulatory approval and may run out of cash or manpower before even beginning commercialization. In addition, many medtech start-ups are staffed by researchers from the academic sector and do not necessarily have business or marketing skills. Manufacturers, therefore, prefer to turn to customers who can provide sustainable purchase commitments and commercial success.

Commercial Potential of Innovations

The eligibility criteria for funding a medical device up to its technological readiness level (TRL) 1 to 6 often focus on commercial potential. Yet the activities funded are primarily focused on R&D—or the product—and not on developing the business system: profit model, network, structure, internal processes, customer service, channels, brand, and customer engagement. If entrepreneurs had more incentive to build a robust business system from the start, companies would reach organizational maturity faster, and the trust of potential partners would be easier to earn. Risk would be reduced from the manufacturers’ perspective. Instead of dealing with clueless scientists, they would be dealing with entrepreneurs ready to succeed.

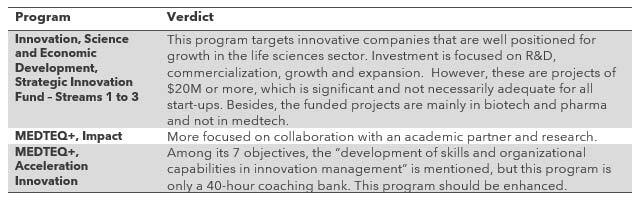

For example, consider the following programs (TRL 1 to 6).

The public funding experts I met agree that the most effective programs are those promoting industry collaboration. The non-profit organization NGen understands that its programs require partnerships. Manufacturers wishing to enter the medical device manufacturing business without having to bear 100% of the risk are well advised to join forces with other manufacturers to increase the supply in Canada. This would be beneficial to them and their new customers. We must also promote our assets—exchange rate, low electricity costs, skilled labour, and free trade agreements—to attract foreign customers. Conversely, imagine five innovative companies joining forces to find one or more fellow manufacturers looking to diversify into medtech. The risk for the manufacturer is reduced by bringing in five customers at once, and this model is well aligned with NGen’s Pilot Projects and Feasibility Studies or Cluster Building programs ($50–500 K). The Supercluster Projects program accommodates collaborations between five or more SMEs for projects up to $20M. However, it is unrealistic to think that such industrial networking will occur without the involvement of consortia and industry organizations: MEDTEQ+, Medtech Canada, NGen, AÉRO Montréal, M&EQ, CTMA, etc.

Networking and Support

The role of consortia is to find companies that work in silos when they can be clustered. These consortia and industry organizations must communicate with each other to create synergies. One company’s problem can become another’s solution—aeronautic manufacturing SMEs that wish to diversify their activities could meet the needs of medtech companies wishing to subcontract locally.

Adding to the example of aeronautic manufacturing SMEs, their efforts still need to be supported to obtain ISO 13485 certification, which specifies the requirements for quality management systems in the medical device industry. For some, this is just an upgrade from their ISO 9001 certification. The Business Development Bank of Canada (BDC) offers a certification mentoring program, but ISO 13485 is not mentioned on its website. I learned from a manufacturing contractor that the BDC has only one person dedicated to this standard based in Ottawa. The consulting firm AVISIO Quality has expressed a willingness to assist manufacturers in obtaining certification but cannot refer them to any program designed for this purpose.

It seems that a manufacturer cannot evolve in the medtech sector on a part-time basis because this sector has its own peculiarities. A medtech start-up develops at a different pace than other sectors; the markets are highly segmented, etc. Manufacturers need to understand this reality to offer quality services and develop the right expectations. This requires training, access to influencers, a presence at medtech trade shows and, ideally, the development of dedicated subsidiaries.

Strategic Alignment

The ideas summarized here are aligned with the Quebec government’s 2022–2027 strategy to support research and investment in innovation. The objective of this strategy is to support procurement for innovative companies in Quebec. In addition to sourcing from Quebec medtech companies, let’s also make sure that their innovations are produced here!